THE PLAY REPORT: CONSUMER ELECTRONICS RETAIL TRENDS EOFY SPECIAL

27 June 2019

Last year, the average annual spend on devices for Australians aged between 18-64 was $772 and growing, when we include the cost of internet subscriptions, Aussies are collectively spending $37 billion in the consumer electronics sector (Suncorp’s Cost of being digitally savvy report).

Many reports attribute the strength of the sector to online sales which certainly play a significant role, particularly in consumer pre-purchase research. However for big ticket items, there’s no denying that consumers want to experience that wide screen TV or world fist audio innovation for themselves, the retail environment matters and having effective, educational point of purchase materials essaynow.net and compelling Brand immersive experiences, can be the difference between a customer choosing to spend their hard earnt dollars with you or the other guys.

End of financial year sales have traditionally been a boom period for the sector, with consumers delaying purchase during the year for items that they expect will be on sale come June, think TVs, top-shelf headphones and white goods.

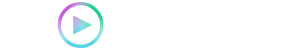

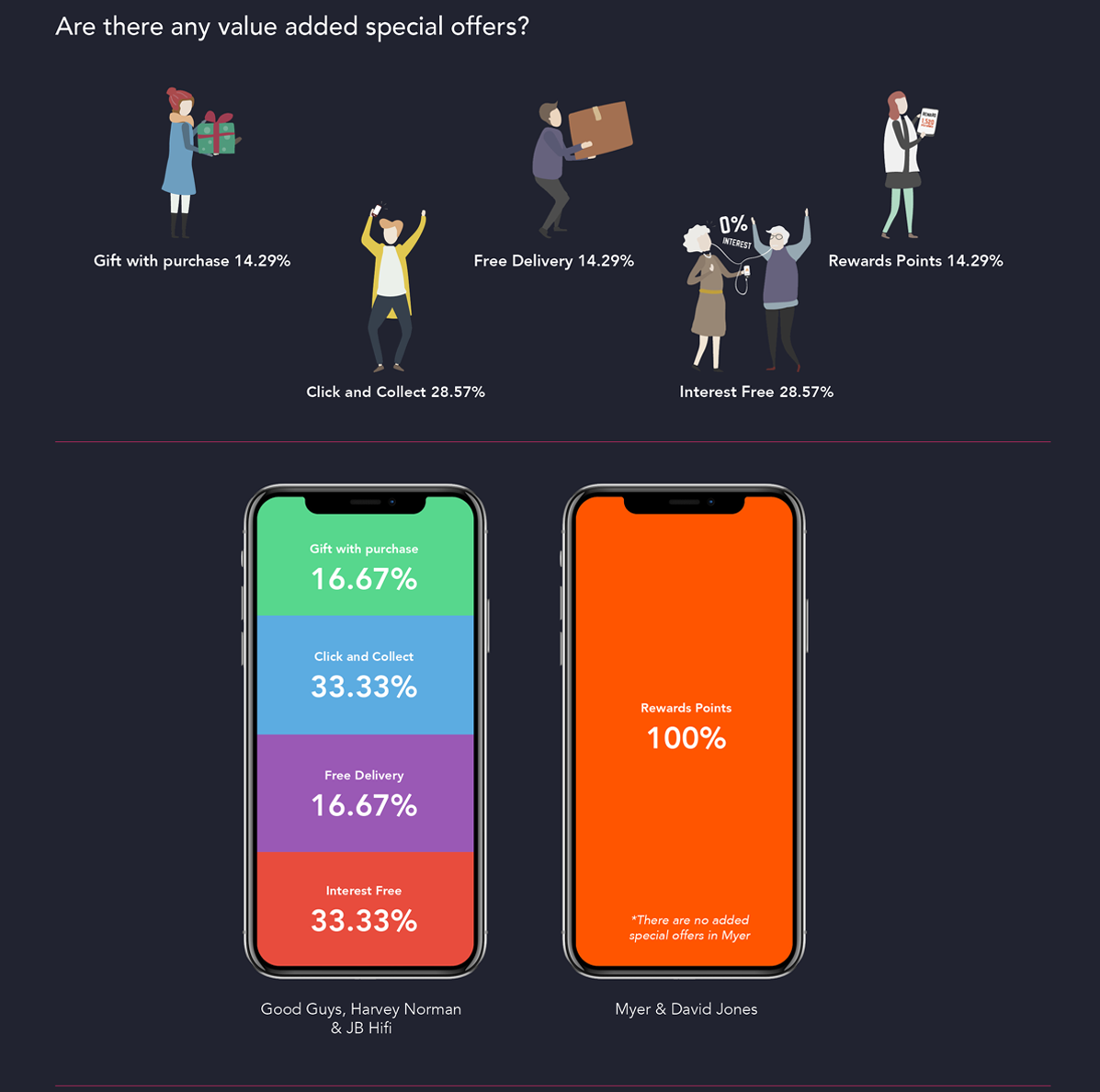

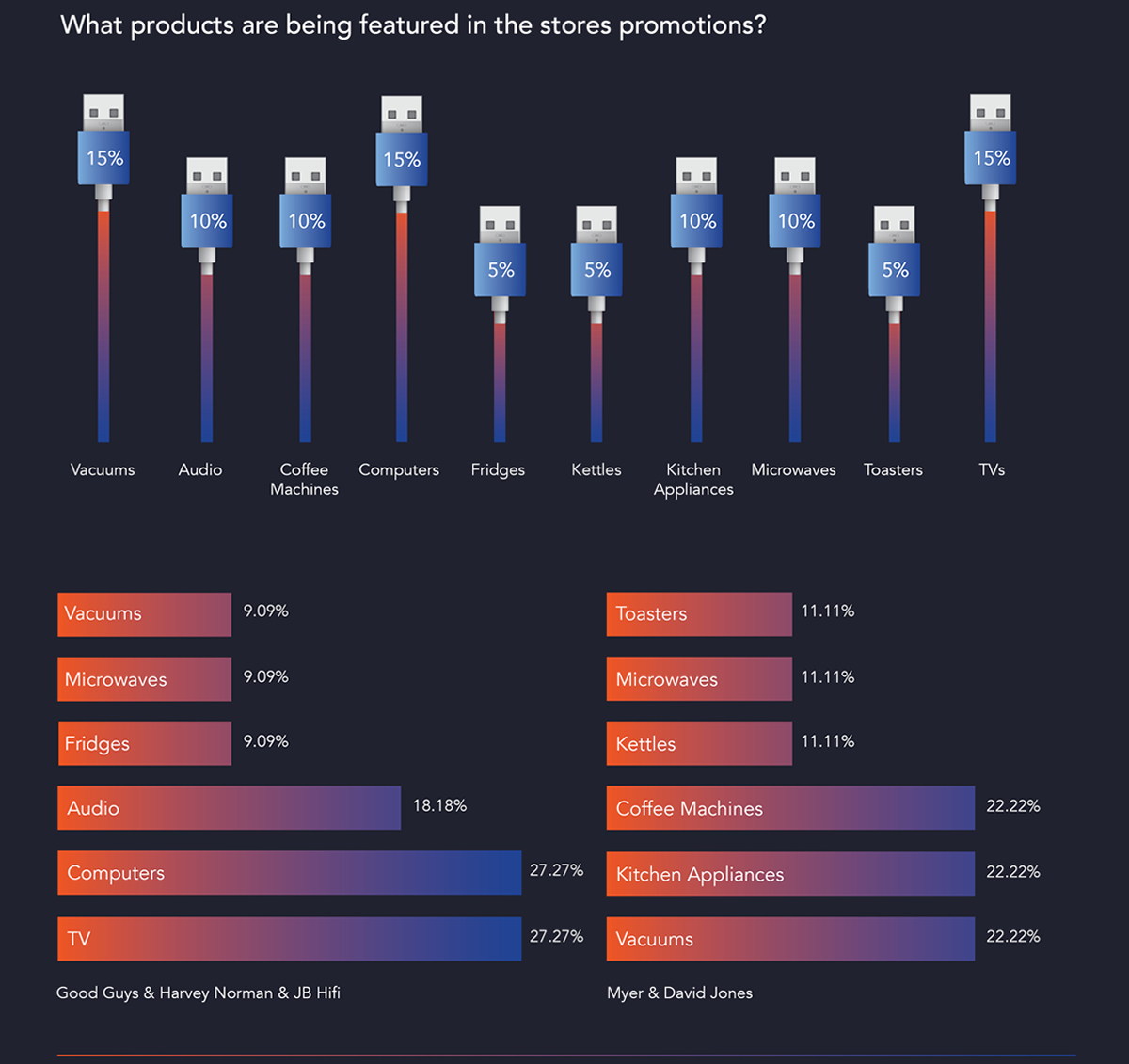

Play Retail took to stores across Australia, visiting key retailers for the sector: David Jones, Myer, The Good Guys, JB Hi-Fi and Harvey Norman. Unsurprisingly, all channels have some form of EOFY promotion running, with deals to be had across home appliances, audio, beauty tech and entertainment. See our findings below.

The Good Guys

Myer

INTERESTED IN ANALYSING YOUR BRAND OR SECTOR?

Our powerful and effective data collection software and technology matched with our impressive geographical people reach, allows us to gather valuable market insights for our clients. Customised to provide regular feedback that is important to your business, our Market Insights can include analytics such as:

– How VM time was spent in store, refill time vs merchandising time

– New product drop availability/store processing delays

– Stock levels including any low stock red flags

– Compliance to POS and VM guidelines

– Competitor activity

– Sales metrics